BlackRock Asset Tokenisation Through Digital Liquidity Fund

Mitchell Nixon

BlackRock Leads with Asset Tokenization with Digital Liquidity Fund

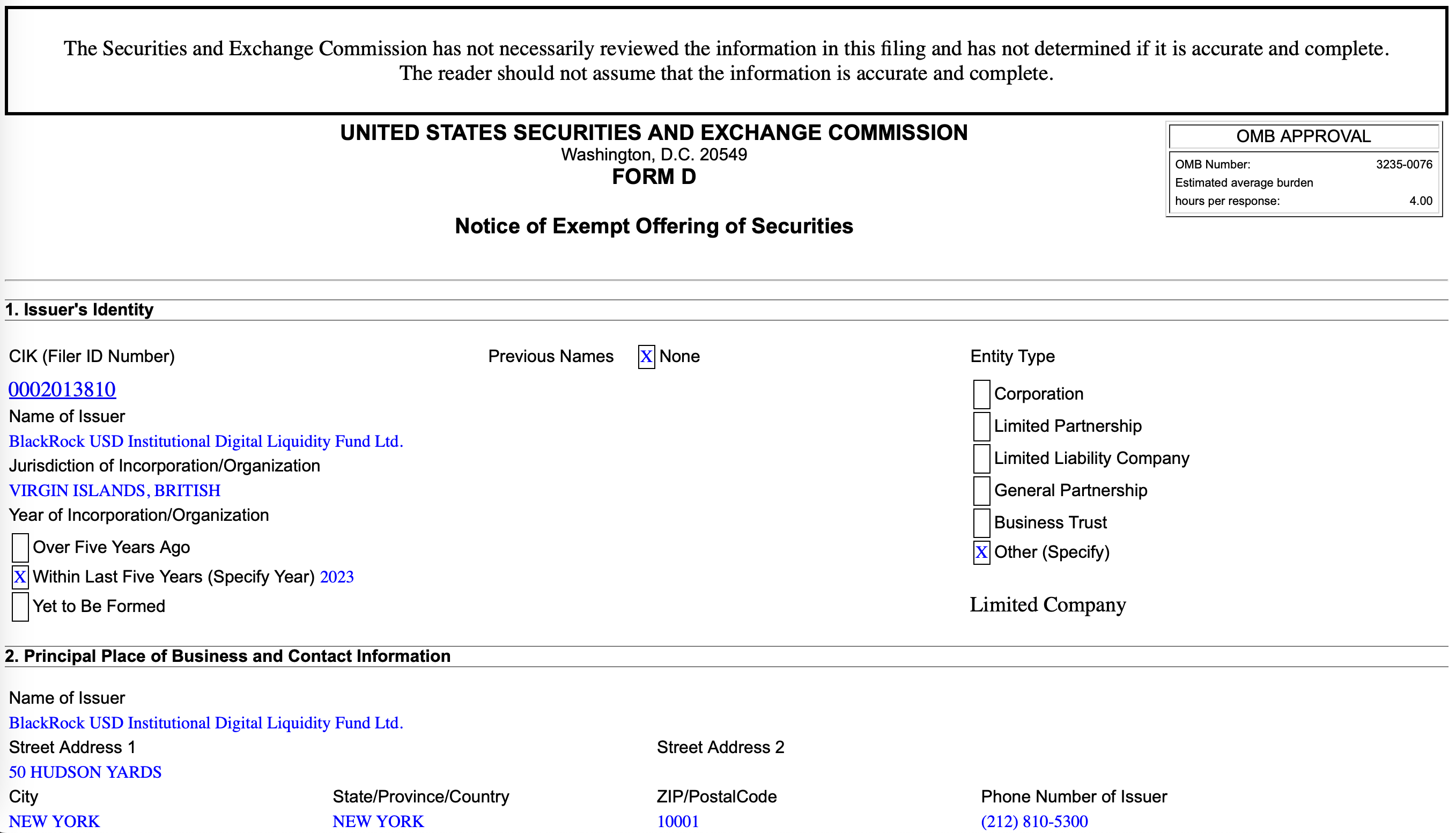

BlackRock, the world’s largest asset manager, has officially entered the world of asset tokenization by submitting a Form D to the U.S. Securities and Exchange Commission (SEC) for its BlackRock USD Institutional Digital Liquidity Fund. This marks BlackRock’s first tokenized asset fund, reflecting the firm’s forward-thinking approach to digital assets.

According to the SEC filing, BlackRock established the fund in 2023 but has yet to publicly launch it. The filing seeks exemptions under the Investment Company Act Section 3(c), freeing the fund from certain SEC regulations. The fund, set up under the jurisdiction of the British Virgin Islands, requires a minimum investment of $100,000.

The sale of tokenized shares will be facilitated by Securitize, a U.S.-based digital assets securities firm that will manage the token sale. The form indicates $525,000 in sales commissions, with the fund size labeled as “indefinite.”

Tokenization on the Ethereum Blockchain

The fund will undergo tokenization on the Ethereum blockchain using an ERC-20 token named BUIDL, which currently has a single holder and a $0 on-chain market capitalization, according to Etherscan. A notable transaction of $100 million was transferred to the fund on March 4, further demonstrating BlackRock’s intent to leverage blockchain technology.

In a related move, BlackRock’s spot Bitcoin ETF was among the first to receive SEC approval earlier this year. Speaking to Bloomberg, CEO Larry Fink shared his vision for the future:

“We believe the next step going forward will be the tokenization of financial assets… Every stock, every bond… will be on one general ledger.”

Fink highlighted that tokenization could eliminate many issues surrounding illicit activities and bring efficiency to financial markets with instantaneous settlement and customization strategies.

Securitize’s Role in Asset Tokenization

Securitize, registered with the SEC, has extensive experience in tokenizing assets for firms like KKR and Mancipi. In addition to its role in this fund, Securitize has partnerships with SBI Digital Markets in Singapore and recently acquired Onramp Invest, a cryptocurrency fund manager with over $40 billion in assets.

Profitability in Crypto Mining with the Right Tools

As BlackRock continues to push boundaries in asset tokenization, the demand for blockchain solutions is set to increase. For those involved in crypto mining or exploring ASIC Mining, understanding the future of digital assets is key to staying competitive. If you’re operating in crypto hosting in Australia, now is the perfect time to analyze your potential returns using a Bitcoin profitability calculator.

Get expert guidance to maximize your mining profitability and ensure you’re prepared for the next big shifts in the crypto landscape. Book a free consultation with Imperial Wealth Crypto today to explore your options in ASIC Mining and crypto hosting in Australia. Visit Imperial Wealth Crypto Consultation to get started.