GOLD: Major Short Squeeze On The Cards

The Dataman

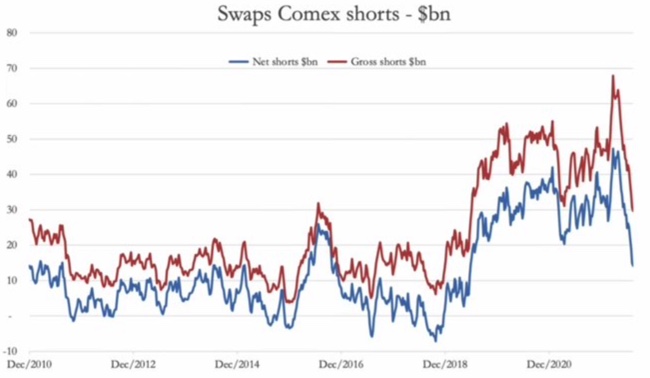

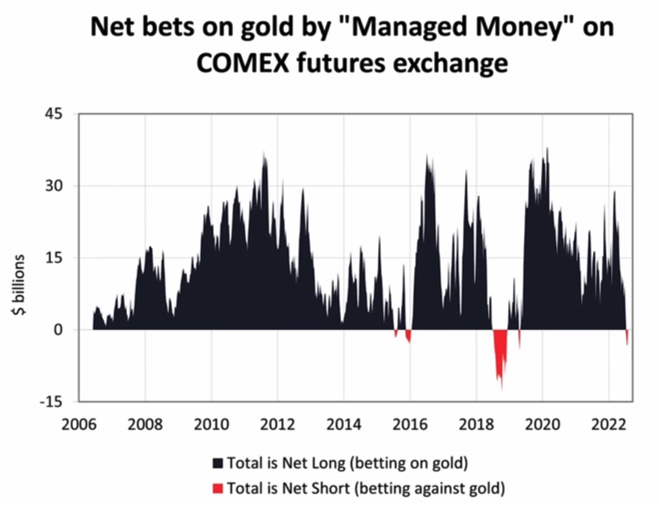

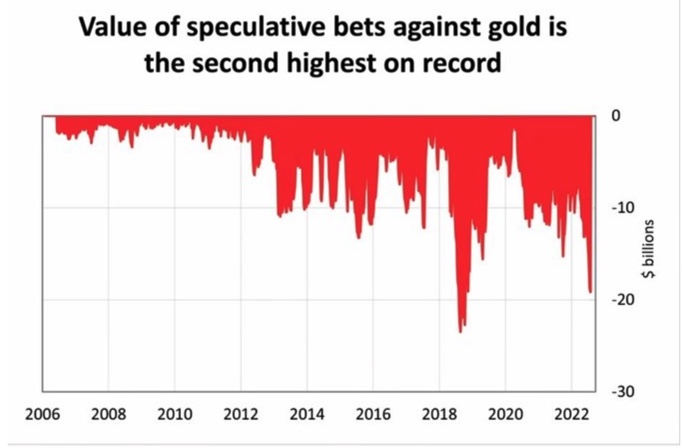

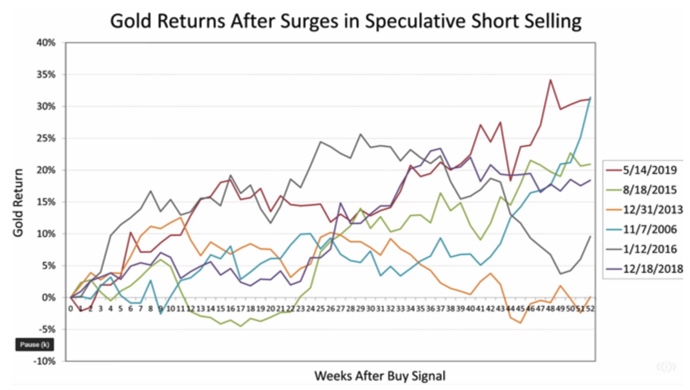

GOLD: Major Short Squeeze On The CardsGold has been a casualty of aggressive interest rate hikes from the FED and other Central Banks around the world. Since the initial spike in gold prices when Russia invaded Ukraine, Gold has been in a steep decline. Generally speaking, when Central Banks reduce money supply through quantitative tightening, the DXY (US Dollar Index) strengthens, and gold weakens as the “real interest rate” begins to move higher. The gold price is also forward-looking and priced in further interest rate hikes into year-end. However, due to recent economic developments and recession fears, the year-end interest rate target is possibly declining and rumours of a FED pivot in September are on the cards. Now, when you take a look at open interest and orders in the market, it gives us an understanding of how bullion bank dealers are positioning. Right now, Swap Comex Short positions are at their lowest level in a number of years. Net shorts have reduced from roughly 50 billion to roughly 12 billion. This tells us the total number of short sellers has declined at the bullion level, and fewer market participants are bearish on the metal. Why Gold is Facing a Potential Short SqueezeFurthermore, the Comex Gold Vault Totals have declined to levels not seen since May 2020. In the last five trading sessions, 26,006 Comex contracts have stood for delivery (2,600,600 ounces, 80.89 tonnes). Central Banks added 59 tonnes to their gold reserves last month. This is indicating big buyers are buying gold and STANDING for delivery and the vaults are being drained. What Low Bullion Short Positions Mean for InvestorsSo, we have a decreased amount of net short positions on gold from bullion dealers, the Comex Gold vault is being drained as big buyers are standing for delivery, and lastly, the value of speculative bets against GOLD is the second highest on record. Speculative bets are classed as managed money. Managed money is currently NET SHORT on gold which has only happened on a couple of occasions in history. When managed money becomes NET SHORT, this indicates an over bearish sentiment and sets up what is known as a SHORT SQUEEZE. There has only been one occasion when the value of speculative bets against gold has been this large, which was back in 2018 (GOLD BULL MARKET). A short squeeze is when the market rallies higher putting pressure on short sellers. This has only occurred 6 times in history. Every time this has happened previously, gold had a very strong performance over a 52-week period. There was only one occasion where gold was not trading higher at 52 weeks post signal, however, this occasion did result in a 15% gain in the short term. Over the past 6 signals, the average 52-week performance has been roughly 20%. With that in mind, and the current price of gold at 1785, if an average 52-week performance takes place gold should be heading higher than the previous 2073 market top over the next year. Keep your eyes on the metals market! This is a huge opportunity you do not want to miss. We are looking to execute positions in the trading floor over the coming weeks on a breakout above the negative trend line resistance. Conclusion: Take the First Step Towards Crypto SuccessThe cryptocurrency market offers incredible opportunities, but navigating it can be challenging without expert guidance. Whether you’re curious about the basics, ready to start investing, or seeking to refine your strategy, Imperial Wealth Crypto is here to help. With a free 30-minute consultation, our experts will provide tailored advice to suit your goals. Whether you need education, setup assistance, or insight into the best products and services, we’ll ensure you’re confident in your crypto journey. Book your consultation today at Imperial Wealth Crypto, or call us now at 1300-644-978. Don’t miss your chance to take advantage of the cryptocurrency industry’s exciting potential! Your future in crypto starts with the right guidance—schedule your call now. Until next time, Tony Fernandez Head Market Analyst |